From Valuation to Closing: A Step-by-Step Guide to Selling Your Manufacturing Business

How to Sell a Manufacturing Business in Ontario

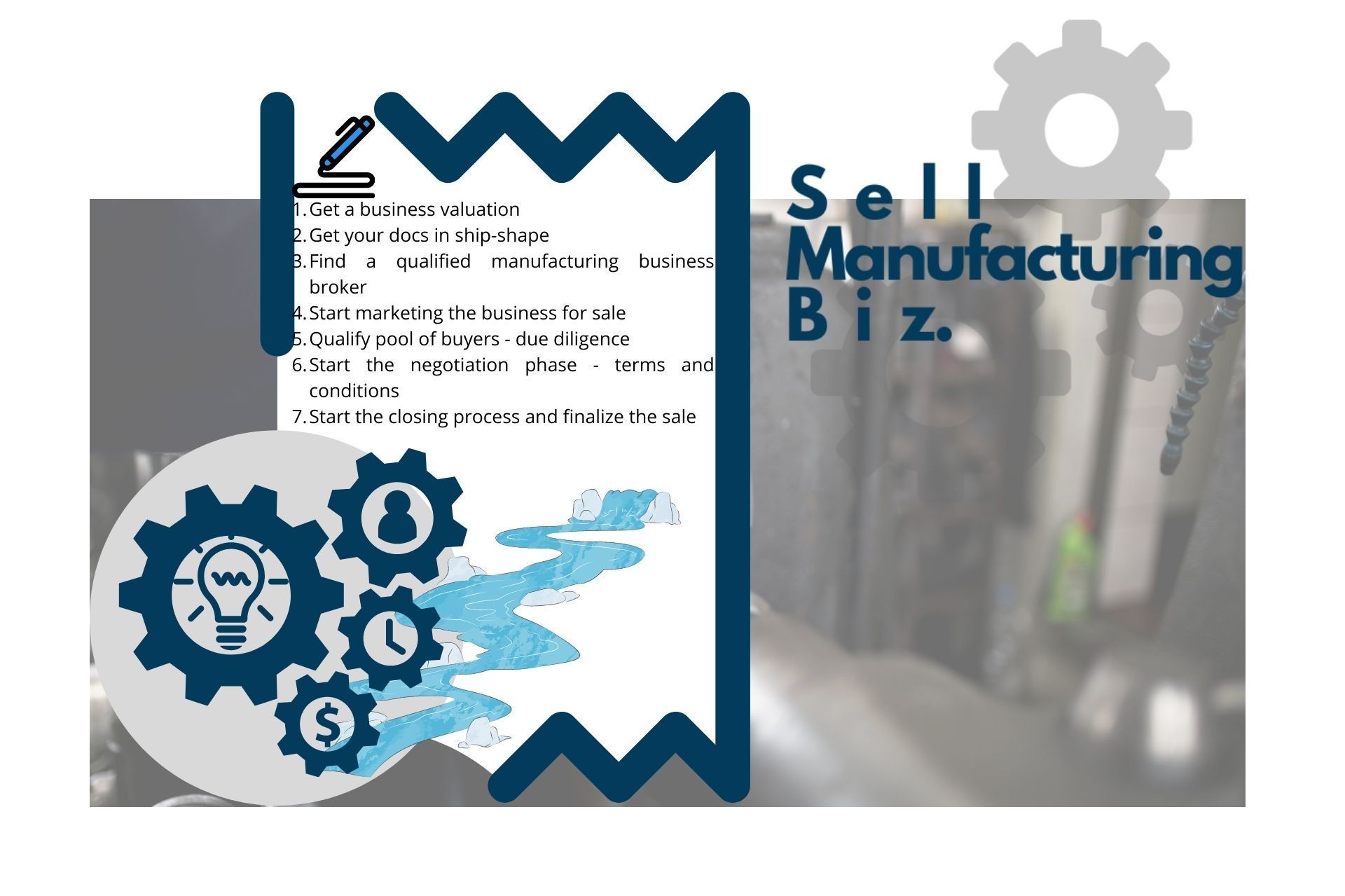

Unlock how to sell a manufacturing business in Ontario. In 7 steps, you'll get to know everything about the selling a business process for manufacturers:

- Get a business valuation

- Get your docs in ship-shape

- Find a qualified manufacturing business broker

- Start marketing the business for sale

- Qualify pool of buyers - due diligence

- Start the negotiation phase - terms and conditions

- Start the closing process and finalize the sale

Are you a manufacturing business owner in Ontario looking to sell your company?

Whether you're ready to retire, explore new ventures, or simply move on to the next chapter of your professional life, selling your manufacturing business in Ontario can be a complex and daunting process.

That's why we're here to help.

In this step-by-step guide, we'll walk you through the entire journey, from valuation to closing, ensuring you have all the knowledge and tools necessary to navigate this critical transaction successfully.

We understand that selling your business is a significant decision, and we're committed to providing you with the expert guidance and insights you need to maximize your return and achieve a seamless transition.

So, if you're ready to unlock the full potential of your manufacturing business in Ontario and embark on a lucrative selling journey, let's dive in and get started!

The Importance of Proper Valuation

One of the crucial steps in selling your manufacturing business is determining its value. Proper valuation is essential as it sets the foundation for the entire selling process.

Valuing a manufacturing business involves assessing its assets, financial performance, market position, and growth potential. It requires a careful evaluation of both tangible and intangible factors that contribute to the overall worth of your business.

To begin the valuation process, it is advisable to engage the services of a professional business appraiser who specializes in manufacturing businesses. They will employ various methodologies to determine a fair and accurate value for your company. These methodologies may include assessing your financial statements, analyzing industry comparables, and considering the potential future earnings of your business.

Once you have a clear understanding of your manufacturing business's value, you can make informed decisions about pricing, negotiation, and marketing strategies. A proper valuation is not only crucial for attracting potential buyers but also for ensuring that you receive an equitable return on your investment.

Now that you understand the importance of valuation, let's move on to the next step in selling your manufacturing business.

Preparing Your Manufacturing Business for Sale

Before listing your manufacturing business for sale, it is essential to ensure that it is in the best possible condition. Buyers are interested in acquiring businesses that are well-organized, efficient, and poised for growth. Therefore, it is crucial to take the necessary steps to prepare your manufacturing business for sale.

The first step in preparing your business is to conduct a thorough audit of your company's operations, finances, and legal documentation. This will help identify any areas that need improvement or attention before presenting your business to potential buyers. It is vital to have accurate and up-to-date financial records, including balance sheets, profit, and loss statements, and cash flow statements.

Additionally, you should evaluate your manufacturing processes, equipment, and inventory to ensure they are in optimal condition. Make any necessary repairs or upgrades to enhance the value and attractiveness of your business. Streamlining your operations and improving efficiency can also make your business more appealing to potential buyers.

Another aspect of preparing your manufacturing business for sale is resolving any legal or regulatory issues. Ensure that all necessary permits, licenses, and compliance requirements are in order. Address any pending litigation or disputes and have a clear understanding of your intellectual property rights.

By thoroughly preparing your manufacturing business for sale, you are positioning it for success in the competitive market.

Now that you have taken the necessary steps to get your business ready, let's move on to the next section and explore how to find a qualified business broker or M&A advisor.

Finding a Qualified Business Broker or M&A Advisor

Finding the right business broker or M&A advisor is crucial when selling your manufacturing business. These professionals have the expertise and network to connect you with qualified buyers and guide you through the complexities of the selling process. Here are some key factors to consider when selecting a business broker or M&A advisor.

First, look for professionals who specialize in manufacturing businesses and have a proven track record of successful transactions in the industry. They should have a deep understanding of the manufacturing sector, its challenges, and its unique selling points. This expertise will ensure that they can effectively market your business to potential buyers and negotiate favorable terms on your behalf.

Additionally, consider the reputation and credibility of the business broker or M&A advisor. Look for testimonials or references from previous clients to get an idea of their professionalism and expertise. It is also essential to assess their communication skills and responsiveness, as effective communication is crucial throughout the selling process.

Furthermore, evaluate the resources and network that the business broker or M&A advisor brings to the table. A vast network of potential buyers and industry contacts can significantly increase your chances of finding the right buyer for your manufacturing business. They should have access to various marketing channels, both online and offline, to reach a wide pool of potential buyers.

Once you have selected a qualified business broker or M&A advisor, they will work closely with you to develop a marketing strategy and identify potential buyers. They will handle the initial inquiries, negotiations, and due diligence process, allowing you to focus on running your business.

Now that you have found the right professional to assist you, let's move on to the next step and explore how to effectively market your manufacturing business for sale.

Marketing Your Manufacturing Business for Sale

Effective marketing is crucial when selling your manufacturing business. It is essential to create a compelling narrative that highlights the unique selling points and potential of your business. Here are some strategies to consider when marketing your manufacturing business for sale.

First, create a comprehensive and professional marketing package that includes all relevant information about your business. This package should include financial statements, operational details, customer testimonials, and growth projections. It should also highlight any competitive advantages, such as proprietary technology or strategic partnerships.

Next, leverage online platforms and industry-specific websites to reach a broad audience of potential buyers. Create a dedicated website or landing page for your manufacturing business, showcasing its key features and benefits. Utilize search engine optimization (SEO) techniques to ensure your listing appears in relevant search results.

In addition to online marketing, consider traditional marketing channels such as print advertisements, trade shows, and industry publications. These avenues can help you reach potential buyers who may not be actively searching online. Networking within the manufacturing industry and attending industry events can also provide valuable connections and leads.

When marketing your manufacturing business, confidentiality is crucial. Ensure that potential buyers sign non-disclosure agreements (NDAs) before disclosing sensitive information. This protects your business's confidentiality and prevents competitors or employees from gaining access to proprietary information.

By implementing an effective marketing strategy, you can attract a wide pool of potential buyers and increase the chances of finding the right fit for your manufacturing business.

Now that you have marketed your business successfully, let's move on to the next step and explore how to navigate the due diligence process.

Navigating the Due Diligence Process

Once you have identified potential buyers and received offers, the next step is to navigate the due diligence process.

Due diligence is a comprehensive examination of your manufacturing business by the potential buyer to assess its financial, operational, and legal aspects. It is a critical step in the selling process and can significantly impact the final terms of the sale. Here's how to navigate the due diligence process effectively.

First, gather all required documents and information that potential buyers may request during due diligence. This may include financial statements, tax returns, contracts, employee records, and any other relevant documentation. Organize these documents in a secure and easily accessible manner to facilitate the due diligence process.

During due diligence, potential buyers will assess the financial health of your manufacturing business, including its revenue, expenses, and profitability. They may also evaluate your customer base, sales pipeline, and market position. Be prepared to provide detailed explanations and supporting documentation for any discrepancies or anomalies that arise during this process.

It is essential to be transparent and forthcoming during due diligence. Disclose any known issues or challenges that the potential buyer may encounter after the sale. This builds trust and credibility and can help prevent any surprises or disputes later in the process.

Throughout the due diligence process, maintain open lines of communication with the potential buyer and their advisors. Be responsive to their inquiries and provide timely and accurate information. This demonstrates your commitment to a transparent and efficient transaction and can help build a positive relationship with the buyer.

Navigating the due diligence process can be time-consuming and demanding, but it is a crucial step in ensuring a successful sale. By being well-prepared and transparent, you can instill confidence in potential buyers and increase the likelihood of a smooth transaction.

Now that you have successfully navigated due diligence, let's move on to the next step and explore how to negotiate the terms of the sale.

Negotiating the Terms of the Sale

Negotiating the terms of the sale is a critical step in selling your manufacturing business. It involves finding a balance between your financial goals and the buyer's expectations. Here are some key considerations and strategies to keep in mind when negotiating the terms of the sale.

First, clearly define your financial goals and objectives for the sale. Determine your desired sale price, payment terms, and any additional conditions that are important to you. This will provide a clear framework for negotiation and help you evaluate potential offers.

Consider the buyer's perspective and understand their motivations and priorities. This can help you tailor your negotiation strategy to align with their needs. For example, if the buyer is focused on a quick sale, you may be able to negotiate a higher sale price in exchange for a shorter transition period.

Be prepared to compromise and find creative solutions that benefit both parties. Negotiation is a give-and-take process, and flexibility can help move the negotiation forward. Consider alternative deal structures, such as earn-outs or seller financing, that can address the buyer's concerns and still meet your financial objectives.

Engage the services of a skilled negotiator, such as your business broker or M&A advisor, to represent your interests during the negotiation process. They can leverage their experience and expertise to secure the best possible terms on your behalf. Remember, negotiating the terms of the sale is an essential step in achieving a successful transaction.

Now that you have negotiated favorable terms, let's move on to the next step and explore the closing process.

The Closing Process and Finalizing the Sale

The closing process is the final step in selling your manufacturing business. It involves completing all necessary legal and financial obligations to transfer ownership to the buyer. Here's what you need to know about the closing process and finalizing the sale.

First, work with your legal and financial advisors to ensure all necessary documents and agreements are prepared and reviewed before the closing date. These may include a purchase agreement, bill of sale, non-compete agreement, and any other relevant contracts. Ensure that all terms and conditions agreed upon during negotiation are accurately reflected in the final agreements.

Coordinate with the buyer and their advisors to address any outstanding due diligence items or last-minute requests. It is essential to maintain open lines of communication and address any concerns or issues promptly. This will help ensure a smooth and efficient closing process.

Consider engaging the services of an escrow agent or an attorney to handle the transfer of funds and assets. They will ensure that all funds are held securely and released according to the terms of the agreement. This provides an added layer of protection and helps facilitate a seamless transition of ownership.

Once all documents are signed, funds are transferred, and assets are transferred, the sale is considered closed. Celebrate this significant milestone and take the time to thank your employees, customers, and partners for their support throughout the selling process.

Finalizing the sale of your manufacturing business marks the end of one chapter and the beginning of another. Now that you have completed the closing process, let's move on to the next section and explore some common challenges that sellers may face and how to overcome them.

Common Challenges and How to Overcome Them

Selling a manufacturing business can present various challenges along the way. However, with the right strategies and mindset, you can overcome these obstacles and achieve a successful transaction.

Here are some common challenges that sellers may face and how to overcome them.

Finding the right buyer

It can be challenging to find a buyer who is the right fit for your manufacturing business. To overcome this challenge, work closely with your business broker or M&A advisor to identify potential buyers who align with your business's values and objectives. Cast a wide net and leverage your network to reach a broader pool of potential buyers.

Maintaining confidentiality

Maintaining confidentiality during the selling process is crucial to protect your business's value and prevent disruption to your operations. Implement strict confidentiality measures, such as non-disclosure agreements (NDAs), and only disclose sensitive information to qualified buyers who have undergone a thorough vetting process.

Managing emotions

Selling a manufacturing business can be an emotional journey, especially if you have invested significant time and resources into building it. Recognize that emotions may arise throughout the process and allow yourself time to process them. Engage the support of your trusted advisors, such as your business broker or attorney, who can provide guidance and objective perspectives.

Dealing with due diligence requests

Due diligence can be an intensive and time-consuming process. To streamline this process, ensure that all necessary documents and information are organized and easily accessible. Be responsive to potential buyers' requests and provide accurate and timely information. Consider engaging the services of a virtual data room to securely share documents and streamline due diligence.

Handling negotiations

Negotiating the terms of the sale can be challenging, particularly when there are multiple parties involved. Engage the services of a skilled negotiator, such as your business broker or M&A advisor, to represent your interests and guide you through the negotiation process. Be open to compromise and creative solutions that benefit both parties.

By proactively addressing these common challenges and working closely with your trusted advisors, you can overcome obstacles and achieve a successful sale of your manufacturing business.

Now that we have explored common challenges and their solutions, let's move on to the final section and conclude this step-by-step guide.

Conclusion and Final Thoughts

Selling your manufacturing business is a significant decision that requires careful planning, preparation, and execution. By following this step-by-step guide, you have gained valuable insights into the entire selling process, from valuation to closing.

You now understand the importance of:

- Proper valuation,

- preparing your business for sale,

- finding a qualified business broker or M&A advisor,

- marketing your business effectively,

- navigating due diligence process

- negotiating the terms of the sale

- and, closing the deal.

Are you ready to know what's next?

Ready to Sell Now or Later: Here's What's Next

If you are a retiring business owner looking to sell your manufacturing business in Ontario, here are six tips to get you started:

1. Plan for your exit. Selling a small and medium size machine shop business in Ontario can take a long time, so it's important to start early and have a clear strategy.

2. Know your objectives and expectations. What are you looking for in a buyer? What are your financial and personal goals? How much are you willing to compromise?

3. Understand your company's value. This is a crucial step to take when planning to sell your manufacturing business in Ontario. You need to know how much your business is worth and what factors influence its valuation.

4. Find the right buyer for your business. There are different types of buyers in the market, such as strategic buyers, financial buyers, or individual investors. You need to find the one that matches your criteria and has the resources and expertise to close the deal.

5. Be ready for due diligence. This is when buyers will want to know everything about your business, from its financial performance to its operational processes. You need to be prepared to provide accurate and complete information and answer any questions they may have.

6. Be flexible and open-minded. Negotiating a deal can be challenging and complex, so you need to be willing to adapt and compromise on some aspects of the deal.

We are a deal team of sell-side M&A advisors, also known as Canada's manufacturing business brokers. We have successfully closed hundreds of deals in:

- Ontario,

- British Columbia,

- Saskatchewan,

- and Alberta, Canada

with more than 15 years of deal-making experience and knowledge to help you sell your business for the best price and terms.

Sell My Manufacturing Biz has a deep understanding of the Canadian market and an extensive network of buyers, which allows us to find the most suitable buyer for your business. We also provide comprehensive support throughout the entire process, from initial valuation to post-closing integration.

At Sell My Manufacturing Biz, we are passionate about helping clients achieve their goals and maximize their value. If you are thinking about selling your profitable SMB manufacturing business, we would love to help you through the process and make it a smooth and rewarding experience.

Are you ready to sell your manufacturing company or are you still exploring your options? Whether you have made up your mind or not, you can start here or call (905) 847-8888 to get in touch with our expert deal team.

Our Certified M&A Advisor, Khaled Baranbo, will personally listen to your challenges and priorities and handle your inquiry with professionalism and confidentiality. Don't miss this opportunity to work with Sell My Manufacturing Biz, the leading broker for small and medium size manufacturing businesses in Canada.

Next, Unlock Success: 5 Benefits of Hiring a Business Broker

Part of tips to selling manufacturing business in Canada series ->

Find a Business Broker Near You in Canada

Get in this queue for a whale’s tail. They are a beauty, eh

We just wanted to say hi and thanks for stopping by our little corner of the web. :) “Go ahead and eat your elephant ears on the chesterfield. I’ll come sit with you as soon as I take these runners off.” But, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your manufacturing company before transition/exit your business.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Joseph-Armand Bombardier, John Molson, Warren Buffett and many more.

Just sign up for our emails below.